Don't Spend!

Don’t Spend! is a sleek and lightweight app designed to show you the potential future value of a dollar if invested today

Summary

Don’t Spend! is a sleek and lightweight app designed to show you the potential future value of a dollar if invested today.

Showing the effects for short term, long term, and S&P 500 investments for four time frames (5, 10, 20, and 30 years), Don’t Spend! is a fun and easy way to show you that investing that dollar today instead of spending it might be the smarter choice. There’s also a “retirement” function that shows you how many days away you are from being able to retire, as well as the impact of spending money in terms of how much closer to retirement you’d be.

This app was meant as an exercise for my first iOS and Android applications. It’s developed in Xcode using Swift 3 for iOS, and in Android Studio using Java for Android. The applications are both completely open source.

iOS GitHub link

Android GitHub link

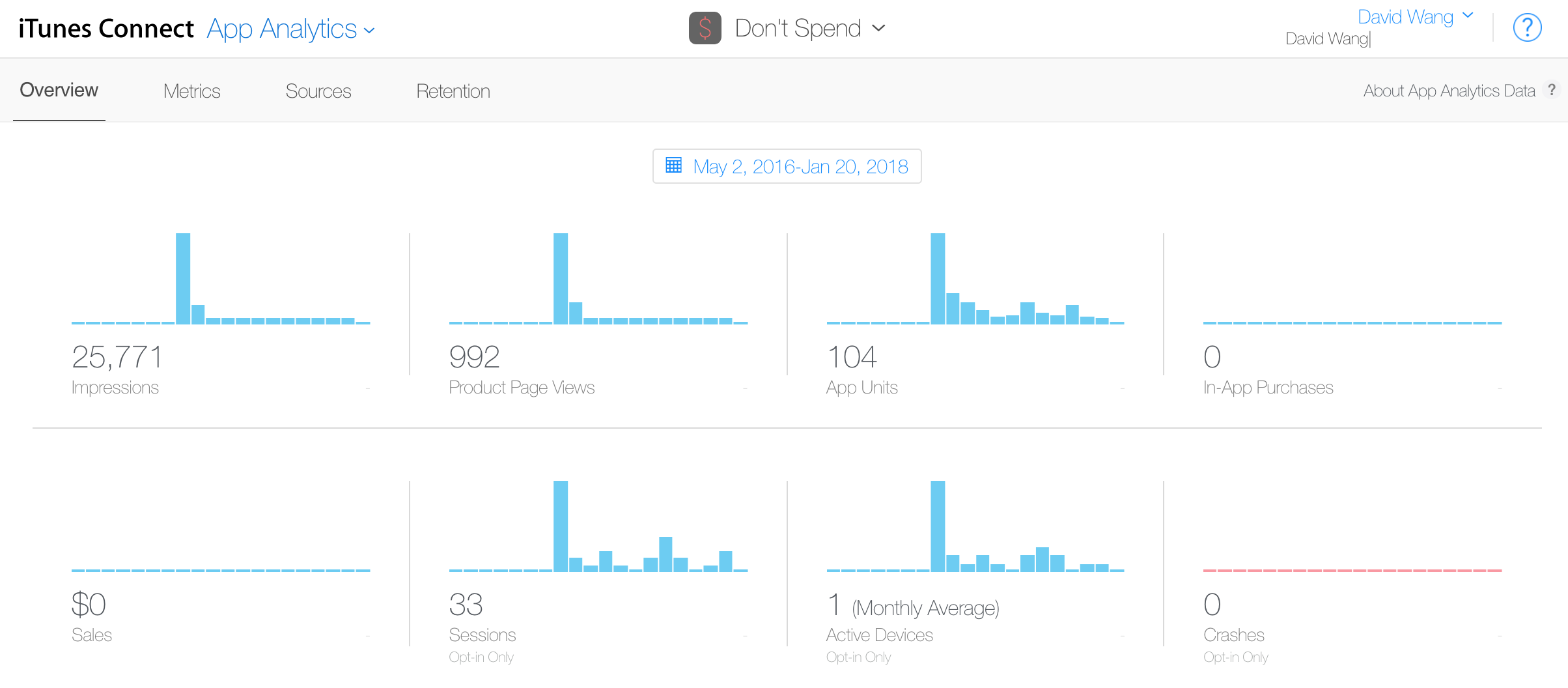

Note: I had gotten this app approved on the iOS store, but because my developer license expired, it has since been removed. I did get a decent amount of downloads though for my first app, and zero crashes!

I had read up on the idea of Financial Independence and I was intrigued. The idea was to save enough money to be able to live off of it forever without having to work anymore (with some smart investments). I wanted to make an app that would help convince me to save instead of spend so I could reach FI earlier.

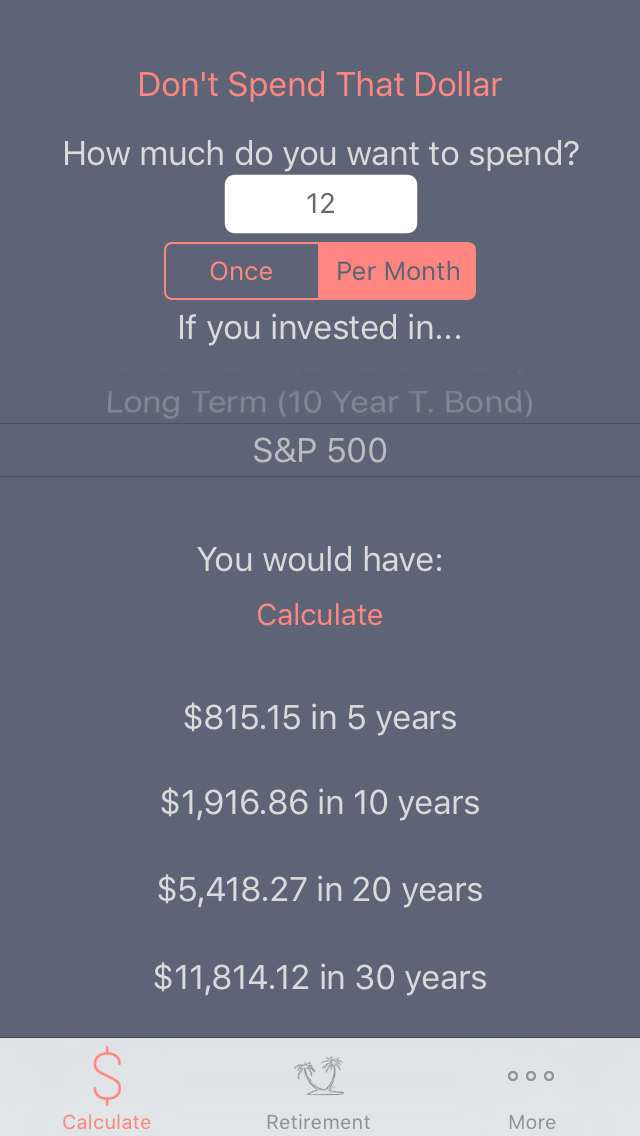

This was my first app, and is basically a financial calculator with some clean design. The first major feature I added was a “don’t spend that dollar” calculator. A user would input how much money they wanted to spend on, say, a new TV. After clicking “calculate”, the app would spit out how much money they would have in the future if they invested it instead.

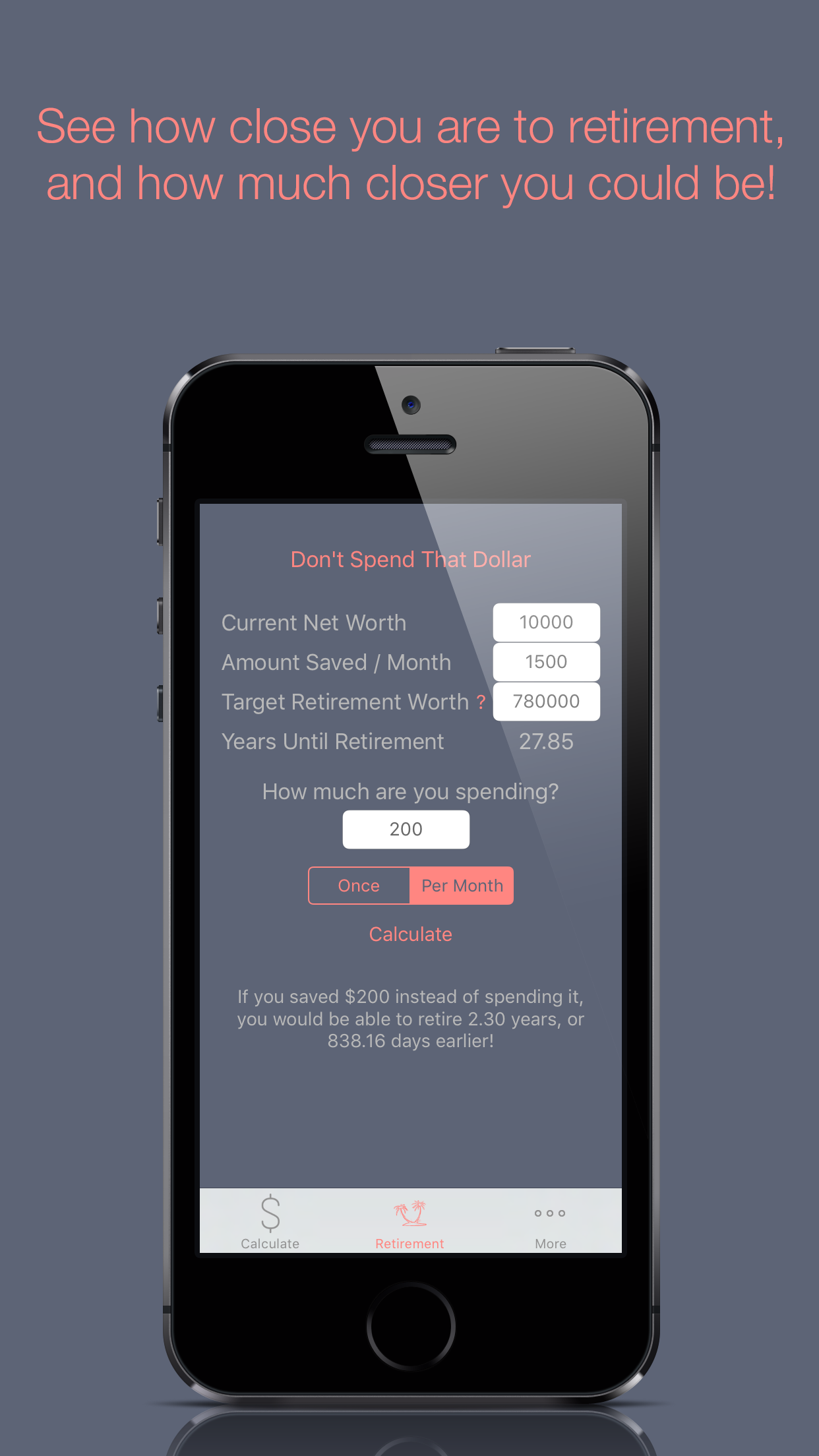

A feature I added in a later update was a retirement calculator. A user inputs how much money they wanted to spend, and their current savings and retirement goal. The calculator would then spit out how many days they would be sacrificing for the money. For example, if I spent $300 on a TV, that would be delaying my retirement by 2 days in 40 years.

This app embodies the idea of "time value of money", a basic concept in finance. The idea is that a dollar today is worth more than a dollar tomorrow because you can invest it. If you invest $100 in a 1% APR interest account, after a year, you will have $101.

Another basic concept is the "risk-return tradeoff". The idea is that a higher risk investment must compensate by offering a higher return. For example, the S&P500 offers the highest average return, but there is also a larger risk associated with the stock market. Short term t bills offer the smallest return, but they also carry the smallest risk. So the average return you should expect with the S&P500 is higher, but the variance is greater. For example, three returns of (14%, 5%, -1%) give you an expected return of 6%, but there is a chance you could get a return of -1%. Three returns of (5%, 5%, 5%) give you an expected return of 5%, but you will be guaranteed to get 5%.

Then there is the concept of "compound interest". This idea is that compound interest can lead to large gains over long periods of time. For example, if you invest $100 in a 1% APR account, in one year you will have $101. In another year, you will have 1% of $101, or $102.01. It is only an extra cent above a dollar, but you can see year after year, you start to earn interest on the interest you've already earned.

One final thing - the real dollar value return of your investment takes inflation into account. If inflation increases, then your dollar is worth less. The nominal dollar value return of your investment is return in today's dollars in the future. It does not take inflation into account, and therefore is usually a less accurate (or more misleading) way of measuring future wealth.